DNA Fund 2025 Mid-Year Outlook

Over the past six months, the cryptocurrency landscape has been a study in contrasts. Seasoned observers might describe the period as simultaneously exhilarating and subdued: headline numbers reached records even as broad-based momentum seemed to stall. Bitcoin entered 2025 at $93,354—the highest calendar-year open in its history—and last week printed a new record weekly close of $109,217.

Macro tailwinds have been equally striking. Institutional engagement has accelerated, underpinned by clearer regulatory frameworks and a wave of crypto-focused IPOs, PIPE financings, and M&A activity designed to give public-market investors direct exposure to digital assets. Traditional equities rallied in tandem: in the weeks following “Liberation Day” (the market’s shorthand for the administration’s tariff-reform announcement), the S&P 500 climbed roughly 30 percent while the Nasdaq added nearly 40 percent.

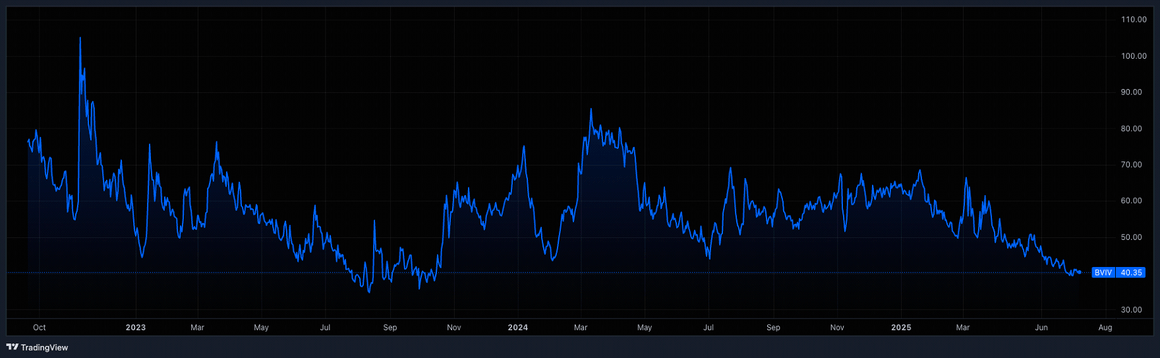

Yet beneath those headlines, the broader crypto market has felt sluggish. Bitcoin retraced almost 50 percent from its Liberation Day lows, but most altcoins failed to participate in the rebound—many, in fact, have continued to drift lower, apart from a handful of narrative-driven outliers.

The above chart speaks volumes: since January 2022, the long-tail of altcoins—those outside the top-ten by market cap—has surrendered 77% of its value relative to Bitcoin. From the peak of the 2024 election rally alone, that same cohort has slid 52% relative to Bitcoin. The first half of 2025 has been anything but ordinary. In the pages ahead, we’ll explore the drivers of these shifting tides and pinpoint the opportunities we view as most attractive for the remainder of the year.

Digital Asset Market Overview

Not long ago, mainstream policymakers and Wall Street leaders dismissed Bitcoin as a sideshow. Per Reuters, JPMorgan CEO Jamie Dimon even scoffed, “I personally think that Bitcoin is worthless.”

Today the narrative has flipped. Celebrated investors such as Ray Dalio, who now calls Bitcoin “hard currency,” and Paul Tudor Jones, who touts it as a core hedge against inflation, have joined a growing chorus of U.S. senators, representatives, and even the President in recognizing Bitcoin as a legitimate store of wealth and strategic portfolio allocation.

Bitcoin is trading near $108,000—roughly 3.5% shy of its all-time high of $112,000. The U.S.

government has emerged as one of the world’s largest holders: its new Strategic Bitcoin Reserve contains about 207,000 BTC (≈ $22.4 billion), which represents nearly 98 % of the nation’s digital-asset stockpile—and an executive order explicitly states those coins “will not be sold.”

Corporate treasuries are following suit. As of late February, 80 publicly listed companies collectively held more than 632,381 BTC on their balance sheets, treating the asset as a twenty-first-century gold reserve against future inflation. That hedge looks increasingly relevant after Congress passed the “One Big Beautiful Bill,” a spending package estimated to add up to $5 trillion to the federal debt over the next decade. If Washington continues to defer meaningful budget restraint, it is difficult to see inflationary pressures abating any time soon.

Bitcoin has climbed 15.7% year-to-date and remains set up for another strong run through year-end. From June 18th to July 3rd, spot ETFs absorbed roughly $3.4 billion of net inflows while the coin’s price rose just 3.3%. That mismatch looks less surprising when one recalls Bitcoin was trading near $75,000 three months ago; after such a rally, a sideways range is natural.

Market-structure signals reinforce the idea that this pause is healthy rather than ominous. The annualized CME futures basis—our preferred gauge of cash-and-carry activity—has barely moved, implying that ETF inflows are not simply arbitrage funds buying spot and shorting futures. Perpetual-swap funding rates have hovered near zero, even flipping negative at times, pointing to muted demand for leveraged longs. Meanwhile, Volmex’s 30-day implied-volatility index has drifted to its lowest level since October 2023, underscoring the market’s collective expectation for contained price action.

Taken together—robust spot demand, a steady basis, muted funding, and compressed implied volatility—we see a coiled spring rather than exhausted momentum. We anticipate further range-bound trading (a temporary dip below $100,000 would not surprise us), but we would view any such shake-outs as attractive opportunities to add exposure ahead of what we expect to be materially higher prices in the second half of 2025.

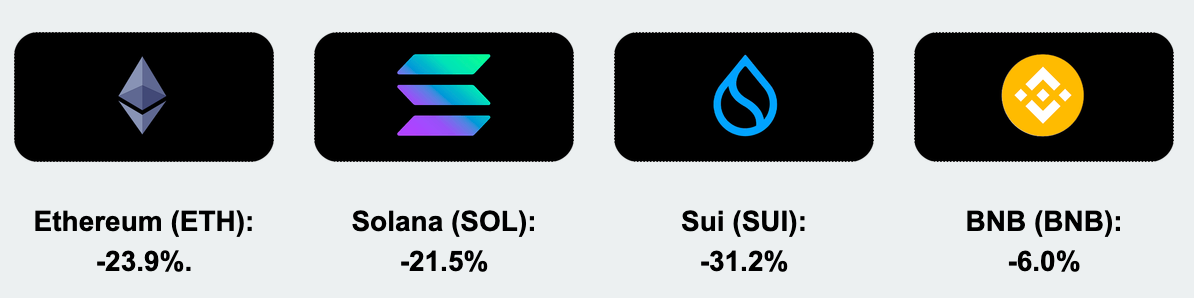

While Bitcoin has gained 15.7% year-to-date, most large-cap altcoins are solidly negative:

AAVE

Aave is a decentralized protocol allowing users to borrow cryptocurrencies without an intermediary. Aave is built on the Ethereum blockchain and is used as a unique set of smart contracts to manage the lending and borrowing process while managing any liquidation process that may arise.

Aave users can deposit various crypto tokens to earn interest. Borrowers, on the other hand, pay interest after providing collateral. Another unique feature is the ability to lock in fixed-rate and variable loans.

When we last wrote about Aave in January, it stood out as a bright spot in DeFi. That trend has continued. While most protocols have seen declining engagement, Aave and Hyperliquid are among the few exceptions. Aave currently boasts $43.7 billion in TVL and $17.5 billion in active loans, maintaining a healthy 40% utilization rate.

The Genius Act

The real catalyst behind Aave’s continued growth over the past few years—and its acceleration over the last 12 months—has been the steady march toward regulatory clarity, particularly surrounding stablecoins. Momentum reached a key milestone in June with the Senate’s passage of the GENIUS Act, a bipartisan bill establishing the first federal framework for payment stablecoins. The bill outlines strict reserve, licensing, and disclosure requirements for stablecoin issuers, mandating 1:1 backing with U.S. cash or near-cash equivalents, monthly reserve reporting, and annual audits. Importantly, only federally approved or state-certified issuers may distribute payment stablecoins, with thresholds in place requiring state-based issuers to transition to federal oversight once issuance exceeds $10 billion. The bill also prohibits yield or interest payments on stablecoin holdings, seeks to standardize custody and redemption practices, and clarifies that payment stablecoins are not securities—removing longstanding legal ambiguity. While the GENIUS Act still awaits House approval and reconciliation with the STABLE Act, both chambers are working toward a finalized version ahead of the President’s August deadline.

For protocols like Aave that rely heavily on stablecoins for collateral, settlement, and borrowing activity, the GENIUS Act represents a tailwind. It strengthens the credibility and safety of stablecoin markets, unlocks institutional adoption, and places regulatory guardrails around trusted issuers—factors that have directly contributed to Aave’s rising utilization and status as one of the few DeFi protocols showing meaningful traction in an otherwise sluggish landscape.

There’s little evidence that momentum is slowing. The combined market cap of USDC and USDT recently surpassed $220 billion, an all-time high. As long as that figure continues to rise, we expect the most trusted and resilient onchain “crypto bank” to keep attracting flows, particularly from investors seeking yield opportunities above what traditional Treasuries offer.

With the GENIUS Act establishing a clear regulatory framework for payment stablecoin issuance, we expect a growing number of crypto-native and fintech firms to pursue formal bank charters. Once an issuer crosses $10 billion in outstanding stablecoins, it must transition

to federal oversight, meaning a national bank charter or a direct license under OCC supervision becomes the only viable long-term path. Beyond regulatory compliance, bank charters unlock structural advantages: access to the Federal Reserve’s payment rails, eligibility for master accounts, and stronger legal protections around reserve custody. Last week, Circle applied for a National Trust Charter.

Hyperliquid

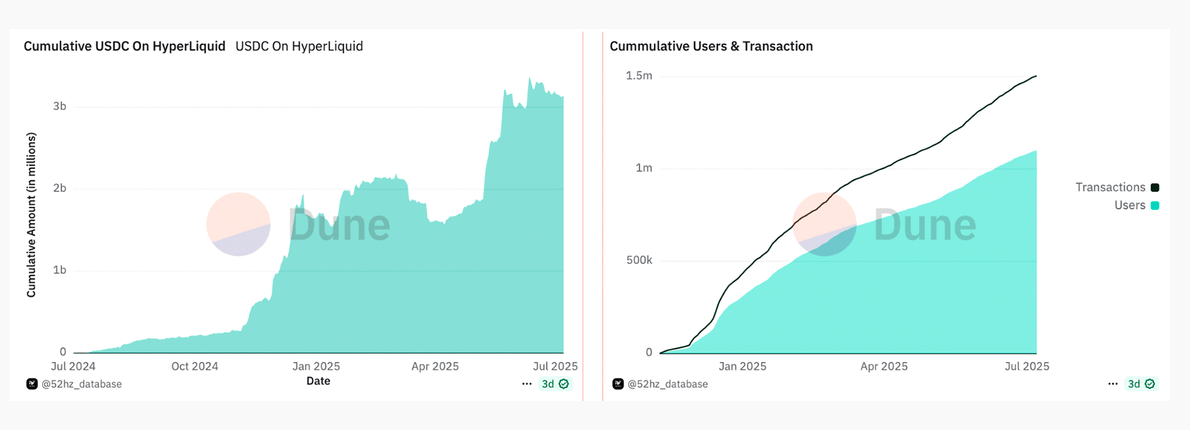

Hyperliquid is arguably the hottest project in crypto right now, and the numbers back it up. Over the past six months, the protocol has generated $330 million in revenue, making it one of the highest-grossing crypto platforms globally, trailing Circle and Tether. Among onchain projects, Hyperliquid, PancakeSwap, and Pump.fun are currently leading the pack in revenue generation. By the time this letter is released, Pump.fun will have just launched its token at a fully diluted valuation (“FDV”) of $4 billion. Hyperliquid, by comparison, is trading at a $41 billion FDV, raising questions about the valuation gap, especially considering the protocol generated $58.5 million in revenue over the past 30 days versus $35.1 million from Pump.fun. Hyperliquid’s metrics continue to accelerate across the board: user growth, deposit inflows, and trading volumes are all rising sharply, and the protocol is steadily gaining market share from centralized giants like Binance and Bybit. The market may still be catching up to the scale of what’s being built.

On the flipside, Pump.fun is beginning to lose market share to emerging competitors like

LetsBonk, all while operating in a memecoin trading environment that has cooled significantly. Volumes and revenues on Pump.fun peaked back in January 2025, whereas Hyperliquid’s core metrics—revenue, user growth, and volume—continue to trend upward. Whether this divergence justifies a 10x difference in fully diluted valuation remains to be seen. The market will have its say soon.

Hyperliquid’s HIP-3 unlocks a new growth vector by transforming the exchange into a permissionless financial-market rail. Beginning Q3 2025, any qualified builder who stakes 1 million HYPE (≈ US $40 million today) can spin up bespoke perpetual-futures markets on HyperCore’s on-chain matching engine, defining their own collateral, oracles, leverage bands, fee splits (up to 50 %), and incentive programs. Because these Builder-Deployed Perps (BDPs) sit outside Hyperliquid’s native HLP liquidity, operators must attract market makers and bootstrap depth themselves—but they retain perpetual fee rights and can monetize order-flow via custom UIs or broker integrations. HIP-3 materially expands Hyperliquid’s TAM, widens protocol cash-flow visibility, and positions HYPE as a high-beta bet on the institutional migration to on-chain derivatives. Very bullish to say the least.

Final Thoughts

We are at a genuine inflection point in crypto. Institutional adoption and improving regulation are unlocking large pools of capital, though where that money ultimately flows is still unclear. DeFi rails have soaked up a surge of stablecoins, but risk capital is concentrated in only a handful of narratives. Our strategy remains to back the fastest horses: we see Bitcoin grinding higher on continued fiscal expansion and growing public distrust of government finances. At the same time, revenue-generating protocols such as Hyperliquid and Pump.fun should draw fresh attention as fundamental investors become comfortable owning tokens with real cash flow.

Hyperliquid is especially compelling as HIP-3 rolls out and perpetual-futures demand expands. With Robinhood preparing its own perpetual offering, Hyperliquid is no longer only chasing Binance and Bybit; it is now competing head-to-head with established fintech brands. For the first time, crypto-native applications are matching capabilities with traditional firms, and the market is waking up to the possibilities. We expect speculative capital to keep pouring into this space, and we are watching for new AI-driven and social applications that can challenge incumbents by giving users clearer benefits and stronger economic alignment.

If you have any questions about DNA Fund, please feel free to reach out.

Contact us: am@dna.fund