DNA Fund September Market Update: Bitcoin, Ethereum, and Solana Insights

Welcome to the monthly DNA Asset Management newsletter. The crypto market remains resilient, with Bitcoin holding above $110K, Ethereum setting a new all-time high at $4,956 last month, and speculation building around Solana DAT companies raising billions to accumulate SOL.

Market Analysis

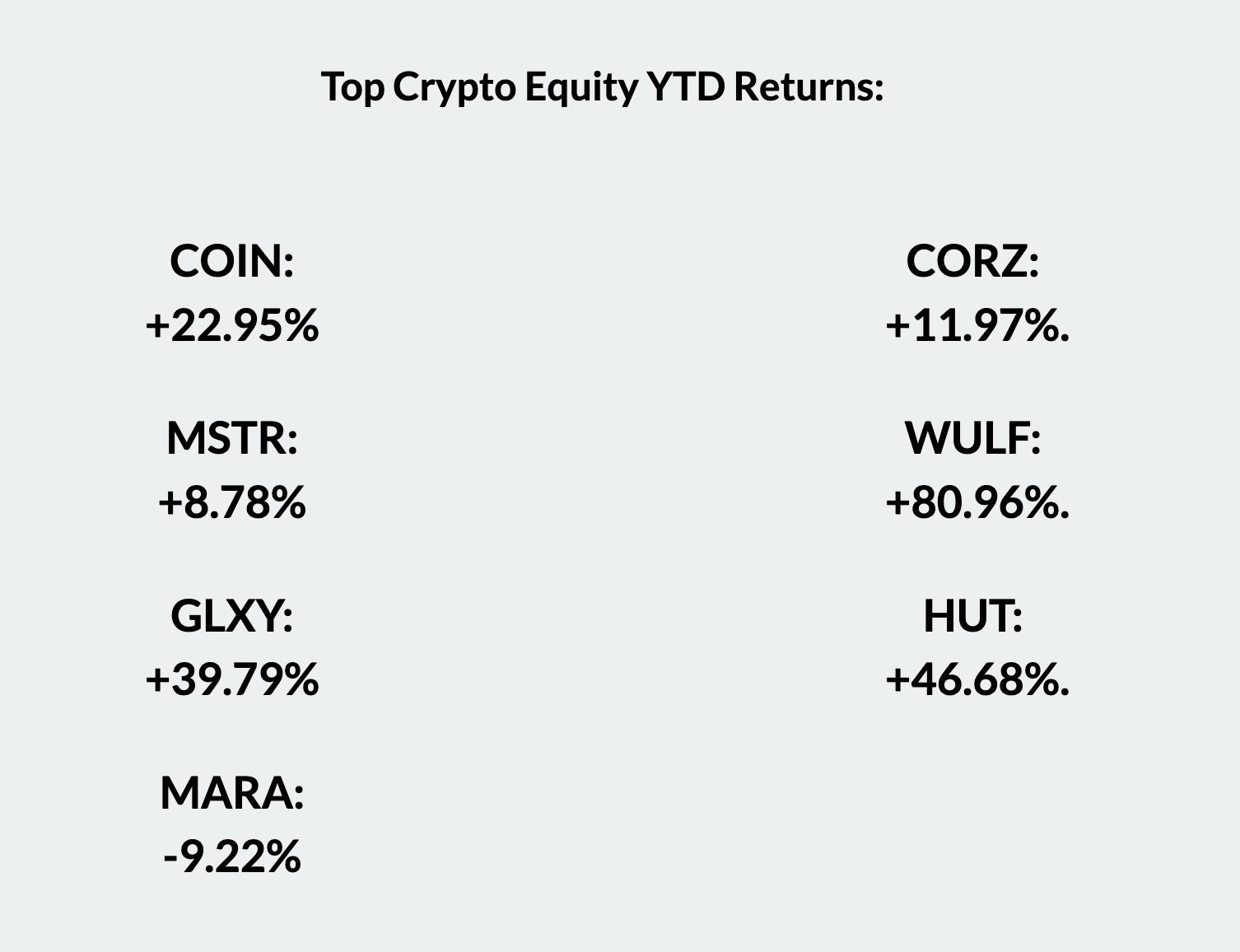

As of September 10th, our internal models remain bullish on Bitcoin and the broader market. Key catalysts supporting valuations into year-end include imminent rate cuts and a potential leadership change at the Federal Reserve that would favor a lower-rate environment. Over the last month, Gold has surged 10% suggesting the market is expecting inflation to run hot once again, but less intervention from the Fed. So far this year, Bitcoin has lagged Gold moves. From January to April, Gold returned +25.3% while Bitcoin returned -19.4%. But from April to August, Gold was flat while Bitcoin returned +40%. So while macroeconomic variables remain supportive, we could see a move up in Bitcoin once Gold settles

While Bitcoin trades in a low-volatility range, capital is rotating into blue-chip tokens such as ETH, BNB, and SOL, driven by flows from Digital Asset Treasury ("DAT") companies.

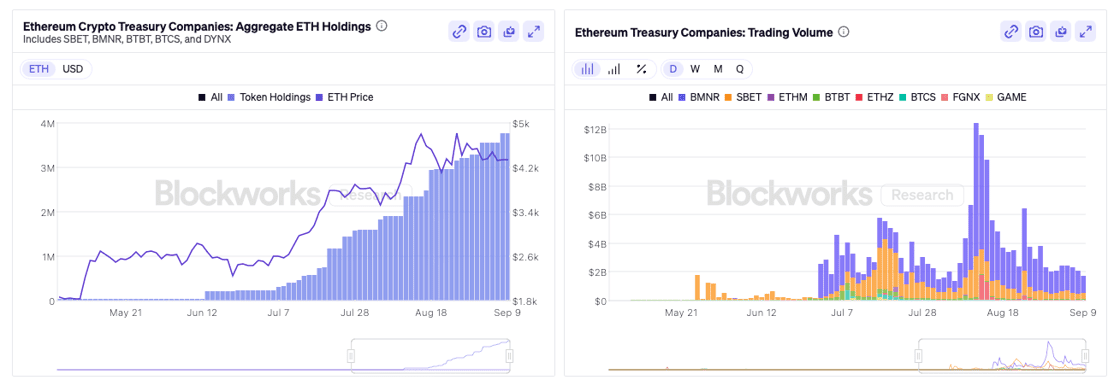

BitMine and SharpLink Gaming are the largest Ethereum Treasury Companies with a combined $12.6B ETH held on its balance sheets. The billions in buy pressure fueled an ETH rally from $1,400 to $4,956 in less than five months. During this period, speculation lifted DAT stock prices above mNAV, enabling Treasury companies to conduct at-the-market ("ATM") sales, issuing shares at prevailing prices and using the proceeds to acquire more of the underlying asset, in this case ETH.

This dynamic creates a reflexive flywheel: as ETH appreciates, the balance sheet value of DAT companies rises. Higher valuations draw more market participants into their stocks, fueled by expectations that these firms will raise additional capital, either through debt offerings or equity sales, to purchase even more ETH. The cycle reinforces itself, as capital raising leads to further ETH accumulation, which in turn supports higher prices.

This reflexive cycle works until speculation stalls and DAT stocks trade below their mNAV, as we are currently seeing with BitMine and SharpLink Gaming. In these situations, companies deploy cash reserves to buyback shares and push valuations back toward mNAV. Since ETH’s breakout to a new all-time high, the price has since consolidated around $4,300.

As shown above, both ETH purchases and trading volumes in Ethereum-focused DATs have slowed significantly, signaling waning speculation and potential opportunities elsewhere. SharpLink Gaming reinforced this thesis by announcing it would use excess cash reserves for share buybacks rather than additional ETH purchases. While ETH interest slows, we are seeing growing interest in Solana and other altcoin DATs.

Solana-focused DATs currently hold only about $1.4B in SOL on their balance sheets compared to $16B for Ethereum-focused DATs. That gap may narrow quickly, with speculation of a new $1B Solana DAT linked to Multicoin (an early Solana investor), Jump, and Galaxy. While this may be just the initial raise, we believe Solana will attract interest comparable to Ethereum among traditional financial players seeking crypto exposure, potentially driving multiple billions in capital inflows over the coming months.

Beyond Ethereum and Solana, we have seen DATs focused on BNB, HYPE, WLD, and DOGE. There will likely be more announcements of DATs related to more niche tokens in the near future, presenting opportunities for investors.

For more information on DNA, our funds, or for investment Inquiries, please contact us.